Asset Protection Services of America

Contact Us

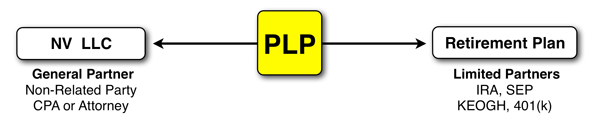

Pension LP

A Pension Limited Partnership is used to hold and own your retirement funds providing protection from creditors. The Pension Limited Partnership is appropriate for cash, in-kind investments and virtually any retirement investment asset. Retirement asset funds are now exposed to creditors if you exercise any control over them or borrow from them. The Pension Limited Partnership is used to protect those assets you have set aside for your retirement in qualified deferred compensation plans such as IRA's, Keogh Plans, 401(k)'s and SEP's.

A pension limited partnership is a limited partnership designed with tax deferral qualifications to continue to defer tax on those assets you have in it. The current rules may allow your creditors to take control of most types of retirement accounts. Generally, self-directed plans are more vulnerable to attacks by creditors. Since your plan assets must be reported yearly to the Department of Labor on Form 5500, the location, amount, and type of your retirement funds can easily be discovered by creditors through the discovery process and your examination under oath in a judgment debtor exam. Armed with this information, creditors may then execute on your funds, possibly leaving your planned retirement in shambles.

Free Asset Protection Consultation

Please complete this form